Money threads through friendships like a quiet wire. Share too much, and it can tighten, tangle, even cut. What feels honest in the moment often invites comparison, pressure, and those sticky favours that turn a laugh into a ledger. The line between bonding and broadcasting is thinner than it looks.

Someone mentioned bonuses, someone else asked about salaries, and the table leaned in as if a secret had just been dropped on the chips. There was a nervous cheer, then a longer silence as people did sums in their heads. The jokes changed shape. The smiles got a little tight. One friend glanced at the bill and stopped laughing. Another said, “Could you spot me this time?” and it wasn’t casual anymore. The air felt heavier. The maths changed.

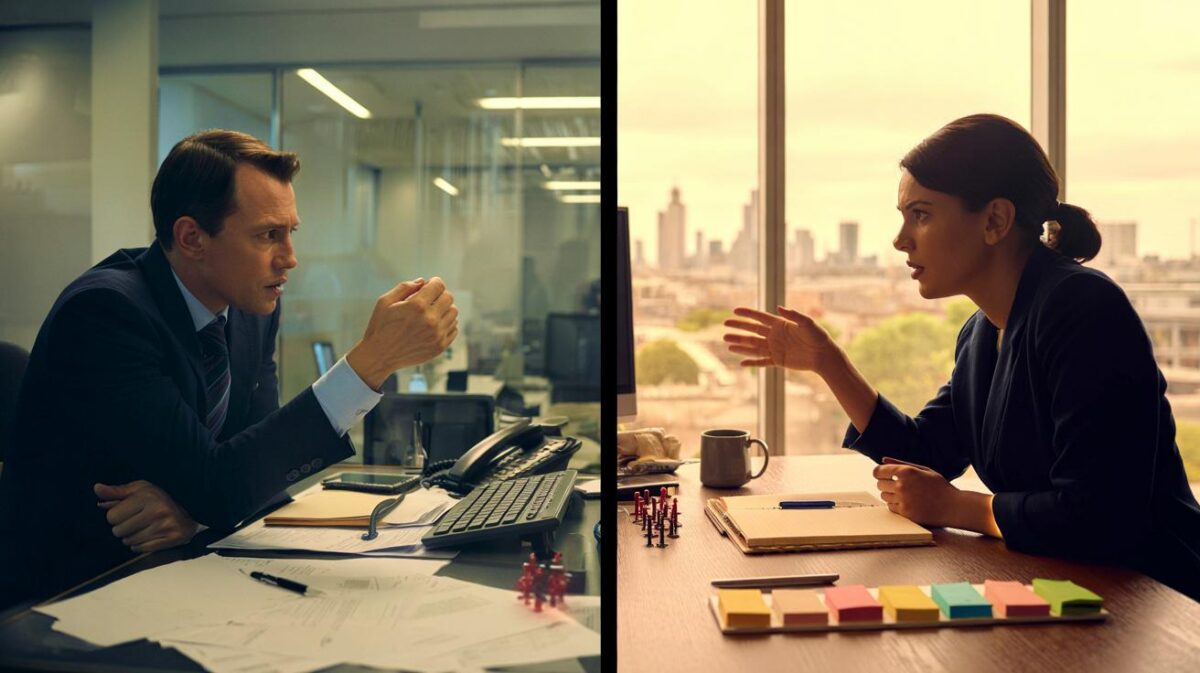

The quiet cost of saying too much

Money talk changes the room. It shifts the social gravity in an instant, moving friendships from easy to edgy. A figure blurted out at brunch becomes a benchmark, and now every pint, present, and plan is measured against it. The moment numbers enter the chat, invisible hierarchies appear. Someone becomes “the rich one,” someone else “the struggler,” and the dynamic hardens.

Think about the friend who posted their house deposit in the group chat—sincere joy, keys in hand, a proud grin. Within a week, a mate asked for a “short-term loan,” insisting it’d be fine. It wasn’t. Repayments drifted, invites dried up, and their easy banter thinned into stilted updates about money. Surveys in the UK regularly find that finances are a top source of friction among friends, especially around lending and trips. You don’t need data to see it. You can feel the awkwardness when the bill hits the table.

Why does oversharing sting? Because money is a signal, not just a resource. It broadcasts status, luck, values, even worth, whether we want it to or not. Numbers anchor expectations and trigger comparison—classic human brain stuff. We start calibrating: who should pay more, who should “treat,” who’s punching above their weight. The friendship turns into a spreadsheet. Generosity becomes an obligation, and boundaries blur until they snap. The horrible outcome isn’t a single blow-up. It’s the slow, grinding chill of trust turning transactional.

Protect your privacy without killing the vibe

Use a simple script when money questions pop up. Keep it warm and firm: “I keep my numbers private, but I’m happy to chat habits and goals.” If a mate pushes, smile and repeat it. Offer a topic swap—“I’ve started automating savings, it’s boringly brilliant”—so you’re not a brick wall. Practise it once in the mirror and it’ll roll out naturally at the table, between the olives and the eye-rolls.

Pre-empt the friction with clean logistics. Suggest bill-splitting apps for group meals and agree the rules before ordering. For holidays, set a shared budget range in the group chat and give an easy opt-out: “No stress if it doesn’t fit.” We’ve all had that moment when a plan spirals into a money marathon. Name it before it eats the friendship. Let’s be honest: no one actually does that every day.

Common trap: confusing privacy with distance. You can be close without itemising your payslip. Privacy is not secrecy; it’s self-respect. Frame your boundary as care, not a rebuke: you’re protecting the friendship, not your ego. If a mate overshares, meet it with empathy and pivot to behaviour, not numbers—“What helped you save?” instead of “How much is in there?”

“Talk about choices, not figures. Choices teach. Figures rank.”

- Phrase bank: “I’m keeping numbers offline, but here’s the tactic that worked for me.”

- Group rules: split evenly by default; large price outliers paid by the chooser.

- Loans: treat as a gift you can afford to lose or decline with kindness.

- Trips: agree a per-day ceiling and a no-judgement opt-out.

- Drinks: swap rounds for pay-as-you-go if incomes vary.

The long game of quieter money

When the numbers stay offstage, friendship can be generous again. Without the weight of comparison, a coffee is just a coffee, not a test of fairness. You can celebrate each other’s wins without writing side essays in your head. You soften the triggers before they spark. Silence can be generous.

This isn’t a call for secrecy; it’s a plea for proportion. If you want to share, share stories, not spreadsheets—the decision to clear a card, the trick that made saving painless, the habit that calmed your brain on payday. Keep it human, close to the ground, stitched with context. Your future self, and your friends, will breathe easier. And when the bill lands, there’ll still be room for laughter.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Oversharing shifts power | Salary and windfalls create instant hierarchies and expectations | Spot the moment dynamics tilt, and stop it before it scars the friendship |

| Use scripts, not spreadsheets | Warm, repeatable lines deflect nosy questions without drama | Stay private while sounding open, kind, and confident |

| Set rules before the bill | Agree split methods, trip budgets, and loan policies up front | Prevent awkward scenes and protect the group from resentments |

FAQ :

- How do I politely refuse to share my salary with friends?Try: “I keep my numbers private, but I’m happy to talk what’s helped me save.” Repeat calmly if pushed and change the subject to habits or plans.

- Should I ever lend money to a friend?If you do, treat it as a gift you can afford to lose, or put a clear repayment plan in writing. Declining kindly is also an act of care.

- What if a friend flaunts their wealth and it bothers me?Shift the conversation to experiences over purchases, or take a breather from comparison-heavy settings. Name how you feel in “I” terms if it’s a pattern.

- How do we split bills fairly without awkwardness?Default to equal splits with an agreed rule: the chooser pays for outliers. For bigger gaps in income, switch to pay-your-own with zero side-eye.

- Is it okay to discuss financial goals with friends?Yes—goals, habits, and lessons help without ranking anyone. Keep figures optional and focus on choices, tools, and mindset.