You’re not imagining it — small, quiet charges are nibbling at your balance. Free trials that rolled over. “Intro prices” that quietly doubled. App-store renewals you never see. That’s how an ordinary household can lose £50 every month without noticing.

A £4.99 here, £7.99 there. A cloud backup you don’t remember starting. A “premium” photo editor you used once. Your bank feed looks like a pick‑and‑mix, only it’s your money. You scroll, then scroll again. The names are slippery: abbreviations, platforms, random merchants that look almost familiar.

We’ve all had that moment where a £1.79 charge raises an eyebrow, and two days later another one lands from the same place. You’re not being reckless. You’re being played by design. A clever drip, not a flood. And it happens quietly.

One debit jumps out with a date you don’t recognise. It’s tiny, but it’s new. You tap. You can’t remember ever tapping “Start free trial” for that brand. Your tea goes cold. Something’s off.

The £50 drip that hides in plain sight

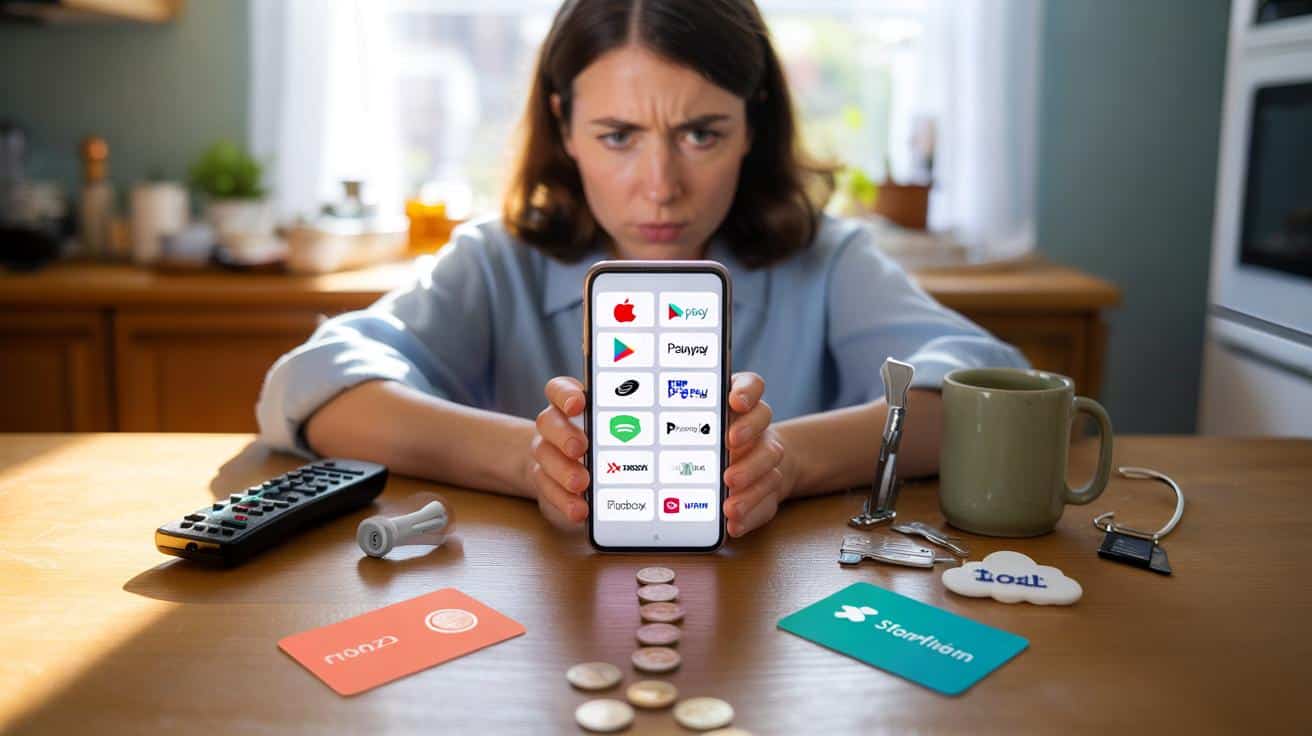

Most subscription traps don’t look like traps. They look helpful. A password manager billed annually after 30 days. A fitness app that starts at 99p, then becomes £9.99. A TV bundle you grabbed for one show and forgot. The trick is fragmentation. Not one giant bill, but ten tiny ones on different dates, through Apple, Google, PayPal and direct debit. You never see the full picture in one place.

Take Maya, 33, in Bristol. She mapped her last 90 days and found a streaming bundle, two music services, a VPN trial, paid cloud, a razor refill, a mindfulness app and a photo editor. Nothing outrageous. Together they were £53.42 every month. She used three. The others were “meant to be temporary”. Recent UK surveys suggest households hold between six and nine paid subscriptions, and a big chunk are barely used after the first month.

This isn’t carelessness. It’s architecture. Free trials flip to paid by default. Cancel buttons hide behind extra clicks. Email receipts drown in newsletters. Prices creep after “intro” periods. And app stores separate your “Subscriptions” from your transactions. You’re busy, so the path of least resistance wins. That’s exactly where £50 slips away — not in one mistake, but in the everyday fog of micro‑payments and nudges.

Stop the £50 leak today

Start with a 30‑minute sweep. Open your bank and card apps and pull the last 90 days. Export to CSV if you can, then sort by merchant. Check the “Subscriptions” pane in Apple Settings, Google Play, PayPal pre‑approved payments, Amazon Prime, and any broadband or mobile add‑ons. Create three columns: keep, maybe, cancel. Hit the obvious “cancel” first, especially anything you haven’t opened this month. Turn off auto‑renew across the rest. *It takes less than an episode of a sitcom.*

Don’t just delete apps — end billing where it began. An Apple trial must be cancelled in your Apple ID. A Google Play sub ends in Google Play. PayPal mandates “Manage automatic payments”. For direct debits, end it with the merchant and, if needed, tell your bank. Screenshot every confirmation page and keep it in a single album. And yes, set a calendar alert for any “keeps” that are on promo pricing. Let’s be honest: nobody really does that every day.

Here’s the golden rule: **cancel in the same channel you started**. If you tapped “Subscribe via Apple”, go back to Apple. If you entered card details on a website, log in there to stop it. Your bank can help too — the Direct Debit Guarantee gives you a quick refund if a company takes the wrong amount or date, and chargeback can cover disputed card renewals.

“If you can’t find the cancel link, change your billing method to a virtual card that expires, then contact support — pressure works once renewal revenue is at risk,” says consumer advocate Rhea Banerjee.

Use this mini‑checklist now:

- Apple: Settings > [Your Name] > Subscriptions — cancel, then remove next‑billing date.

- Google Play: Play Store > Payments & subscriptions > Subscriptions — toggle off auto‑renew.

- PayPal: Settings > Payments > Manage automatic payments — cancel authorisations.

- Direct debit: cancel with the merchant, then confirm in your bank app. Consider a refund under the Guarantee if mis‑billed.

- Amazon: Account > Memberships & Subscriptions — manage Prime, channels and Subscribe & Save.

- Consoles: PSN/Xbox account > Subscriptions — turn off recurring billing.

- Bank tools: Monzo, Starling and Revolut flag repeats — use their “Recurring” filters.

Own your subscriptions, not the other way round

The aim isn’t to live like a monk. It’s to make each subscription earn its keep. Put your “keeps” on one card, set all billing on the same date, and cap the total — say £25 for entertainment, £10 for productivity, £5 for storage. Switch to annual only when you’ve used something for three straight months. When a promo ends, treat it like a new purchase: compare rivals, ask for a retention deal, or rotate services monthly. One out, one in.

There’s also power in friction. Use a virtual card for free trials and set it to expire. Name subscriptions in your budgeting app with verbs — “Watch football”, “Back up photos” — so the purpose stays visible. If you see “Back up photos” and you haven’t opened it in weeks, that’s a nudge to decide. And if a price jumps mid‑contract, challenge it. You might not always win, but customers who ask for a better deal often get one.

In a year where everything feels pricier, reclaiming £50 a month is a quiet victory. It won’t fix the mortgage, yet it will put air back in your budget. You’ll feel it on payday, and on the last day before payday. That’s the moment the drip stops — not because you became a spreadsheet robot, but because you made the game visible.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Map the money | 90‑day export, sort by merchant, check Apple/Google/PayPal/Direct Debits | Reveals hidden duplicates and zombie trials |

| Cancel where it started | Stop billing in the original channel, screenshot proofs | Prevents stealth re‑billing and failed cancellations |

| Make rules, not guesses | Set a monthly cap, one‑in‑one‑out, align billing dates | Keeps spending predictable and under control |

FAQ :

- How do I find everything I’m paying for?Check your bank and card apps for repeats, then Apple Subscriptions, Google Play, PayPal automatic payments, Amazon “Memberships & Subscriptions”, and your broadband/mobile account add‑ons. Some banks label “Recurring” merchants — use that filter.

- I missed a free‑trial cancel. Can I get a refund?Ask the provider first — many offer a grace period if you haven’t used the service. If you were misled, request a refund and reference the 14‑day cooling‑off rights for online contracts. Failing that, try a card chargeback.

- Is it enough to cancel the direct debit?It stops payments, but the contract may remain open. Always end it with the merchant as well. If a wrong amount/date was taken, the Direct Debit Guarantee can refund you quickly via your bank.

- Are companies allowed to hide the cancel button?They shouldn’t. UK consumer rules require clear information and easy exits. If you’re stuck in loops, email support and complain in writing. Escalate to the platform (Apple/Google/PayPal) if needed.

- Can I negotiate a lower price?Often. Start a cancellation, then pause on the retention screen. Ask for a monthly discount, student pricing, or a downgrade. Be ready to switch — rivals run new‑customer deals all year.