Thousands leave it too late, risking frozen accounts.

Consumer champion Martin Lewis is urging households to sort a lasting power of attorney before costs climb. Without one, relatives can face months of red tape, while money sits locked and urgent care choices stall. The registration fee in England and Wales is £82 per document today, rising to £92 on 17 November.

Why Martin Lewis says act now

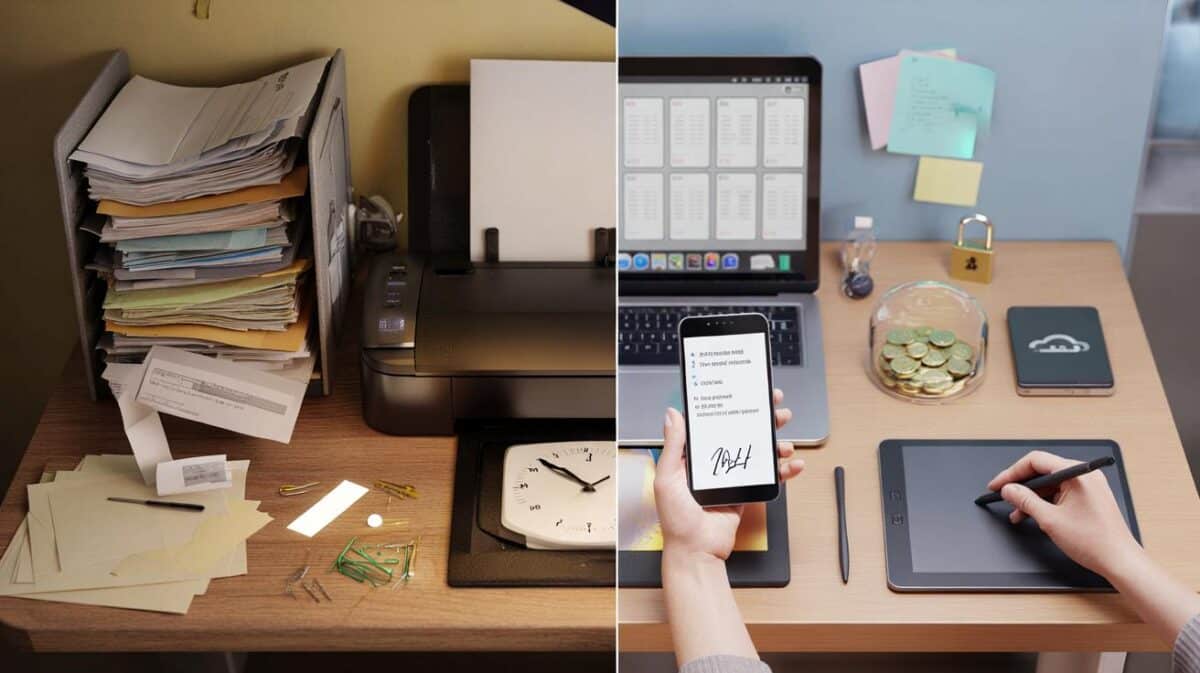

Many people focus on writing a will and forget what happens if illness or injury strikes during life. Lewis argues that a lasting power of attorney (LPA) can matter sooner than a will, because a loss of mental capacity can happen overnight. Banks do not accept “I’m the spouse” as authority. Care homes and hospitals look for written legal powers when decisions must be made.

No registered LPA means loved ones can be shut out of accounts and big decisions just when clarity is needed most.

In the absence of an LPA, families usually apply for deputyship through the Court of Protection. That route involves forms, medical evidence, fees and delays. Meanwhile, direct debits can bounce, mortgage payments can be missed and providers may ask for funds up front.

What is a lasting power of attorney?

An LPA lets you (the donor) choose trusted people (your attorneys) to act if you can’t decide for yourself. You stay in control while you have capacity, and you can limit what attorneys can do. The Office of the Public Guardian (OPG) must register the document before it’s used.

Two versions to consider

- Health and welfare LPA: covers decisions about care, medical treatment, daily routine and, if you permit it, life‑sustaining treatment.

- Property and financial affairs LPA: covers managing bank accounts, paying bills, collecting pensions and benefits, investments and property sales. You can allow it to be used while you still have capacity, which helps if illness or mobility issues make admin difficult.

Everyday decisions it can cover

- Giving or refusing consent to specific treatments and procedures.

- Choosing or changing care arrangements, including care‑home placement.

- Running current accounts and savings, and arranging standing orders.

- Managing investments and pensions within your stated preferences.

- Selling a home to pay for care, if you authorise this.

An LPA names who makes the calls on health, care, money and your home—and sets boundaries while you’re well.

£82 today, £92 from 17 November

The government has confirmed a £10 increase to the registration fee for each LPA in England and Wales from 17 November. Many people make both types, so that’s two fees per person.

| Type of LPA | Fee today | Fee from 17 November | Charged per document? |

|---|---|---|---|

| Health and welfare | £82 | £92 | Yes, per person |

| Property and financial affairs | £82 | £92 | Yes, per person |

Cost help exists. Low incomes may qualify for a 50% reduction, and some means‑tested benefits can bring a full fee exemption. You’ll need evidence to claim a reduction.

For a couple making both LPAs each, acting now can save £40: four documents at £82 versus four at £92 after 17 November.

Who you can appoint and the safeguards

Attorneys must be over 18. Anyone named for financial decisions should not be bankrupt. You can appoint more than one attorney and decide whether they act jointly (all must agree) or jointly and severally (they can act together or on their own). You can also name replacements to step in if needed.

- Attorneys must follow your instructions and act in your best interests.

- They keep records and must keep your money separate from their own.

- They can’t profit from the role or mix finances.

Every LPA includes a “certificate provider” who confirms you understand what you’re signing and are not under pressure. Witnesses must sign in the correct order. The OPG checks documents before registration.

How to set it up before the fee change

- Choose your attorneys and talk through your wishes, values and limits.

- Decide how they’ll act (jointly or jointly and severally) and name replacements.

- Complete the official forms online or on paper, adding any instructions or preferences.

- Arrange a suitable certificate provider and eligible witnesses; follow the signing order.

- Send the forms to the OPG with payment and keep certified copies once registered.

Registration can take several months. If you need help soon, start now. For financial LPAs, you can authorise use while you still have capacity so attorneys can assist with admin immediately.

Mistakes that trigger delays

- Missing signatures or dates, or dates entered in the wrong sequence.

- Ineligible witnesses or certificate providers.

- Using correction fluid or making hard‑to‑read amendments.

- Instructions that contradict each other or create uncertainty.

- Not stating whether the financial LPA can be used before loss of capacity.

Small errors bounce forms back. Check every name, date and signature before posting.

If you skip it, expect hurdles

Without an LPA, families often apply for deputyship via the Court of Protection. That process comes with application and supervision fees, annual reporting and time pressure. Banks can freeze accounts and utilities can pause changes until authority is granted. The administrative load lands just as relatives are managing medical crises.

How rules differ across the UK

England and Wales use the LPA system outlined above. Scotland has its own powers of attorney and registers them with the Office of the Public Guardian (Scotland). Northern Ireland uses enduring powers of attorney for property and finances and has separate health arrangements. Residents should follow guidance for their nation.

Do you still need a will?

Yes. A will deals with your estate after death. An LPA sets out who acts for you while you’re alive but unable to decide. Most households benefit from both. If money is tight, many prioritise the LPA first because incapacity can block access to funds instantly.

Extra help, examples and practical angles

Fee reductions: if your gross annual income sits below a set threshold, you may get 50% off the LPA fee. People on certain means‑tested benefits can qualify for a full exemption. Keep payslips or benefit letters to hand when applying.

Scenario planning: imagine a two‑adult household where one person has a stroke. Without an LPA, joint accounts may be restricted, insurers and lenders ask for formal authority, and care providers request up‑front payments. With a registered financial LPA, an attorney can continue paying the mortgage, manage benefits and keep bills current. With a health and welfare LPA, the same attorney can discuss care plans and treatment preferences with clinicians.

Choosing attorneys: pick people who are organised, financially careful and calm under pressure. You can appoint a professional as one of your attorneys if family dynamics are complex or if you run a business. Use instructions to set limits—for example, “do not sell my home unless two independent valuations show it’s necessary to fund care”.

Business owners: if you’re a director or sole trader, a tailored financial LPA can keep payroll moving and suppliers paid during illness. Consider a separate business LPA with a colleague or co‑director alongside a personal one with family.

Storage and access: agree where to keep the original and certified copies. Tell your bank and GP once the LPA is registered so they note it on your file. Review the document after major life events such as moving, marriage, separation or when an attorney’s circumstances change.

What to write in preferences: include care wishes, regular charitable gifts you’d like to continue, investment risk limits, or a preference for two signatures on any property sale. Clear drafting reduces disputes and speeds up decisions when time matters.