It’s stitched into school runs, packed lunches, and the way we fold receipts in a purse. The trouble is, what kept her safe in her twenties might quietly hold you back in yours.

I’m at my mother’s kitchen table in Leeds, a chipped mug of tea cooling next to the biscuit barrel. She’s telling me, again, that “rent is dead money” and that one credit card purchase can spiral into ruin. She means well. She always has. I watch the steam fade and try to explain that interest rates, housing costs, and work itself don’t look like they did in 1998. She shakes her head, smiling, as if I’m auditioning for a lesson I don’t need. A robin thumps the window and the conversation shifts to dinner. She thinks she’s protecting me. She is — but at a price. And that’s where the trouble starts.

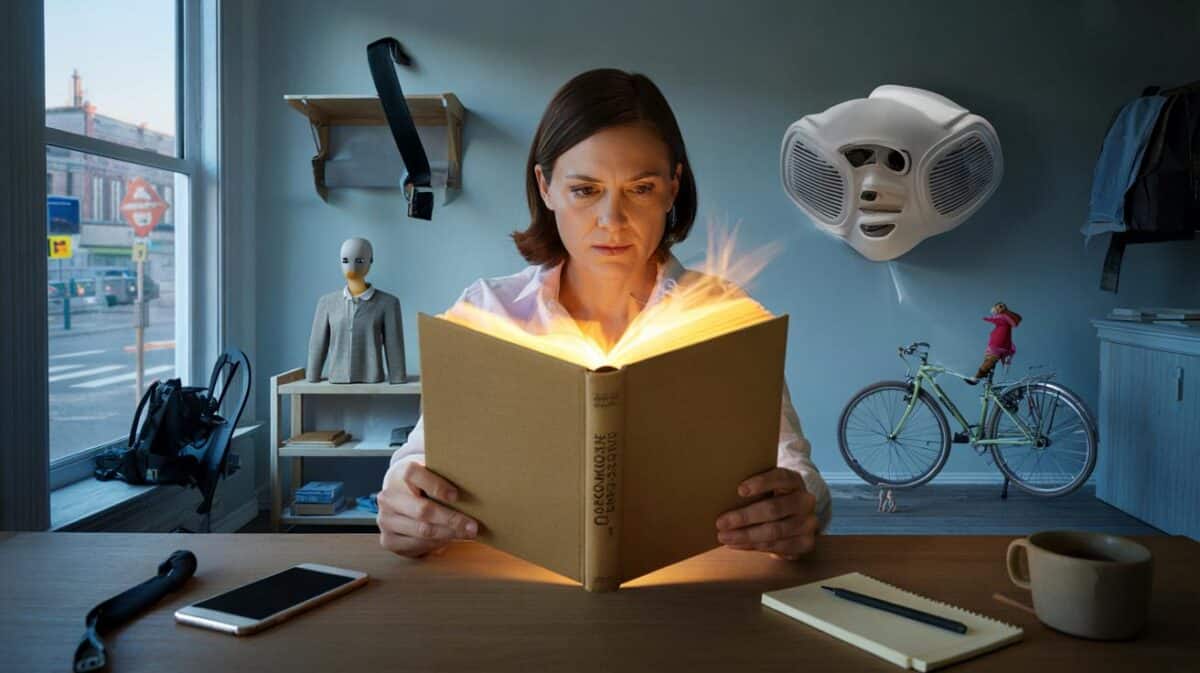

Why loving advice can quietly cost you thousands

Mum’s wisdom often begins with safety. Spend less than you earn. Keep your money where you can see it. Buy a home as soon as you can, even if it stretches you thin. It sounds wholesome because it is. Yet the worst advice is often the most comfortable: “Keep your savings in cash,” “Never touch the stock market,” “Pay off everything before you invest,” “Property never fails.” **Cash under the mattress quietly loses value every year.** You don’t feel the loss. But inflation does its slow work.

Take Jess, 29, a nurse in London. She’s saved £18,000 over five years in a standard account because “shares are like gambling,” as her mum would say. Between 2021 and 2023, prices rose by roughly 15% while her account paid 1–2%. Her money went backwards in real terms, even as she worked nights. She also opted out of auto-enrolment for a year to “get ahead.” That meant turning down free employer pension money. It felt tidy. It wasn’t smart.

Why does this advice cling? Mum lived through 15% mortgage rates in the early 90s and watched property become a lottery ticket. She saw neighbours burn on store cards and vowed never to borrow again. That shapes a worldview. Today, the danger is different. Wages are flatter. Housing is pricier. Cash isn’t a haven when inflation eats it. Risk is not the villain; unmanaged risk is. Let’s be honest: nobody really does that every day. Saving is safety. Building wealth is strategy.

The smarter alternative: modern money habits that actually work

Start with one move: pay yourself first. Skim 10–20% of your income into two buckets on payday — an emergency fund and long-term investing. Automate it so your future gets paid before your landlord or your brunch. Build 3–6 months of expenses in easy access savings, then push surplus into a global index fund inside an ISA or pension. **Pay yourself first, then let automation do the heavy lifting.** It’s unflashy. It works while you sleep.

The traps are familiar. Waiting for the “right time” to invest. Treating rent as “dead money” and stretching for a mortgage that strangles your life. Using credit cards for points without paying in full. We’ve all had that moment when a parent’s voice plays in our head at the till. You’re not failing if your path looks different. Renting can be smart if the numbers stack and your investments grow. A credit card can be a tool if you clear it monthly. The rule isn’t “never borrow.” It’s “never pay for yesterday’s purchases tomorrow.”

Money talk lands better when it honours where it came from. Listen to your mum’s story before you share your spreadsheet. Then offer a bridge, not a lecture.

“Mum’s rules kept us safe when money was scarce. Safety without growth is stagnation.”

- Open a high-interest easy access account for your emergency fund this week.

- Increase your pension contribution by 1% this month and capture the employer match.

- Set a standing order into a global index fund ISA on payday.

- List your debts by interest rate and target the highest first with extra payments.

- Plan a “money chat” with your mum over tea — swap one old rule for one new habit.

Rethinking the family script — without starting a row

You don’t have to torch the family rulebook to update it. Try translating it. “Rent is dead money” becomes “Housing is a cost — choose the version that frees cash to grow.” “Never invest” becomes “Invest little and often in what you understand.” “Only buy a house” becomes “Own if it fits your life and maths, not your fear.” *Money is a bridge between generations when we let it be.*

There’s grace in admitting both truths at once. Mum’s advice protected you. The world has changed. Instead of arguing about moral worth — spender vs saver, renter vs owner — talk in trade-offs. Would a smaller home plus a larger ISA make more sense? Would an offset mortgage keep options open? Could you test investing with £50 a month before changing the whole ship? These are human choices, not exam answers.

Here’s the quiet win: update the script together. Show her how inflation works against cash. Show yourself how fear fades with a written plan. **Rent isn’t dead money; bad value is.** Share your goals in years and feelings, not just numbers. Mum wanted stability for you. Now you can add growth and time freedom to the mix. On most days, that’s what she wanted all along.

Every family carries a money story: saved coins in a jar, a mortgage paid off early, a job lost and dignity kept. The worst advice is rarely malicious; it’s a time capsule. If you gently crack it open, you find love, worry, and a sense of duty. From there, build a version that fits your life today — with interest rates that move, careers that zigzag, and dreams that don’t fit a neat mortgage amortisation schedule. Call your mum. Ask her what scared her most about money at 25. Then tell her what scares you now. Between those answers, a smarter plan starts to breathe.

| Point clé | Détail | Intérêt pour le lecteur |

|---|---|---|

| Outdated cash-only mindset | Inflation often outpaces easy-access rates; cash is for emergencies, not long-term growth | Protects your savings’ buying power over decades |

| Mortgage-at-all-costs myth | Rent can be rational if it frees capital to invest and preserves flexibility | Prevents being “house poor” and supports balanced wealth |

| Fear of investing | Low-cost global index funds, ISAs and pensions with pound-cost averaging | Simple, repeatable path to compounding returns |

FAQ :

- Is rent really “dead money”?Rent buys shelter, location, and flexibility. It’s not dead if the trade-off lets you invest and live within your means.

- Should I pay off all debt before investing?Kill high-interest debt fast. If rates are low and you have a match, invest at least to the employer match while clearing balances.

- Are credit cards bad?They’re a tool. Use them for protection and rewards only if you pay in full monthly; otherwise they’re expensive loans.

- How much should I keep in cash?Three to six months of expenses in an easy access account. More if your income is variable or you have dependants.

- What if the market crashes just after I invest?Keep buying on schedule. You’re purchasing more units at lower prices; time in the market beats timing the market.